In UAE VAT, the taxable event is 'supply' of goods and services. This means, whenever goods or services are supplied by a registered person, VAT @ 5% needs to be charged. It is crucial for every business to understand the relevance of supply which sets the scope of transactions being liable for levy of VAT.

What is Supply under UAE VAT?

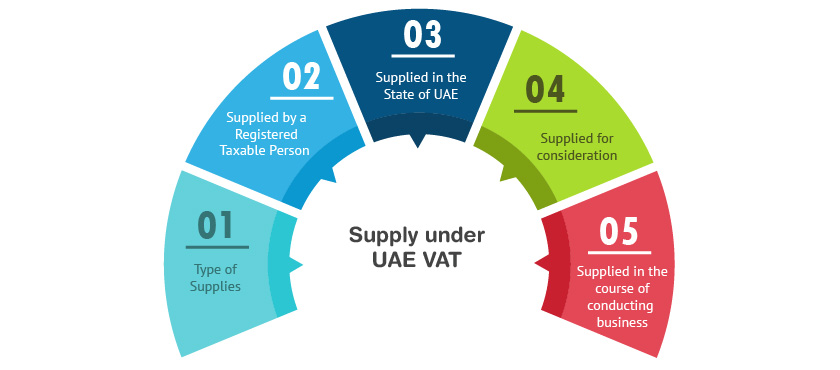

The term 'Supply' includes all forms of supply of goods or services supplied by a registered taxable person in the state of UAE for a consideration and in the course of conducting a business. If you look at the definition of supply, there are 5 critical components as listed below:

For you to determine whether a transaction is in the scope of VAT levy, each of the above components needs to be considered. Let us discuss this in detail:

| Supply in UAE VAT | |

|---|---|

| Supply of Goods and services | Taxable supplies, supplies liable for Reverse Charge Mechanism and import of goods are within the scope of VAT levy. Exempt supplies are out the scope of VAT levy. |

| Supplied by a Registered Taxable Person | It should be supplied by a person who is registered under VAT or a person required to be registered. |

| Supplied in the State of UAE | VAT will be due only when supplies are made in the State of UAE. Place of Supply will determine whether supply is made in UAE or not. |

| Supplied for a consideration | Here, consideration refers to anything collected or to be collected by the taxable supplier from the customer or a third party against the Supply of Goods or Services. Consideration is inclusive of VAT amount. |

| Supplied in the course of conducting business | Business include: any activity conducted regularly, on an ongoing basis, independently by any person, in any location, Including industrial, commercial, agricultural, professional, service or excavation activities or anything related to the use of tangible or intangible property |

Related Articles:

Supply of Goods and Services in UAE VAT

Zero-Rated Supplies in UAE VAT

Difference between zero rate, exempt and out of scope supplies in UAE VAT