The United Arab Emirates (UAE) Cabinet has implemented a new reverse charge mechanism on electronic goods among registered businesses. This is applicable from October 30, 2023. With this blog, let’s understand the change and how to manage RCM on electronic devices using TallyPrime.

RCM on electronic devices in UAE VAT

As per the latest amendment, if your business is selling electronic devices to a registered recipient in the UAE and the recipient intends to either resell such devices or use them to produce or manufacture electronic devices, then you will not be liable for calculating VAT in relation to the supply of electronic devices.

The recipient of electronic devices should calculate VAT based on a reverse charge mechanism. In simple words, the recipient should self-calculate the VAT and claim the eligible input tax credit on such purchases.

Conditions for the reverse charge mechanism for electronic devices

In order to apply the reverse charge mechanism, the following conditions must be met:

- The buyer should give a written declaration to the supplier stating that the intention of the supply of electronic devices is to resell or to use the electronic devices in the production or manufacturing of electronic devices

- A formal declaration attesting to the recipient's FTA registration is required

Before making any supplies, it is critical as a supplier to ascertain the buyer's VAT status and his intention to buy.

How to manage RCM for electronic devices in TallyPrime

TallyPrime offers you a simple workaround to keep your business running without interruption until the necessary product adjustments are made to comply with the new requirement.

Let’s start with sales.

Sale of electronic devices

If you are selling electronic devices to VAT registered business who has provided a declaration that they intend to resell or consume it for further manufacturing devices.

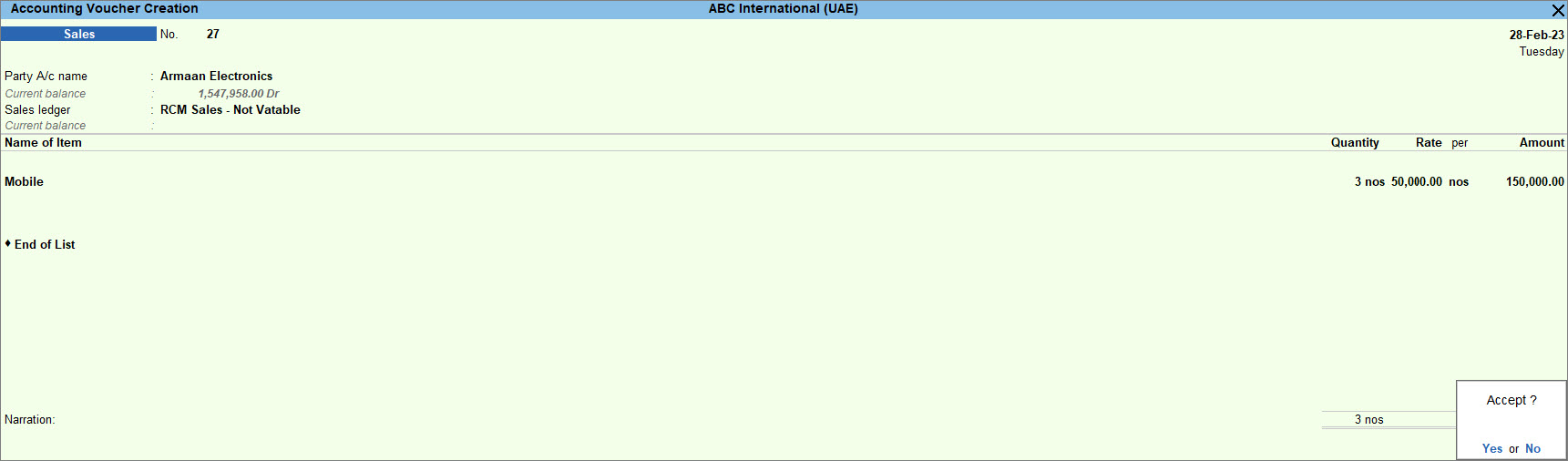

In this case, you need to simply record a sales voucher without the Output tax. You can follow the below steps to record the sales voucher:

- Create a new Sales ledger and set the Taxability as Not Vatable

- While recording the sales voucher, you need to select the new sales ledger that you have created

The above transaction will show as ‘Not Relevant for this Return’ in VAT return form 201. Also, note that there will be no change to sales made to unregistered business or end consumers.

Purchase of electronic goods

If you are registered business purchasing electronic goods by providing the declaration discussed above, you need to calculate the VAT on RCM basis by recording a purchase voucher. Given the purchase is on RCM basis, the buyer needs to increase the VAT liability and subsequently claim the input tax credit by recording the journal voucher.

Recording Purchase voucher

- Create a new Purchase ledger and set the Nature of transaction as Domestic Purchases - Designated Zone

- Record the purchase voucher by selecting the new purchase ledger

Alternatively, if you don't want to create a new purchase ledger, you can override the Nature of transaction for the default purchase ledger in the transaction and select Domestic Purchases - Designated Zone while recording purchase voucher.

Recording Journal voucher for booking VAT liability on purchase

- Press Alt+G (Go To) > type or select Reverse Charge Report

- Press F2 (Period) to change the period

- Press Alt+J (Stat Adjustment)

- Select Increase of Tax Liability & Input Tax Credit as the Nature of adjustment

- In the Additional Details field, select the option Purchase from Designated Zone, and set Is declared to Customs to No

- Mention the narration as 'The voucher is for RCM on Electronic Devices' and save the voucher

In the VAT 201 report, you can view the transaction in Reverse Charge under Sales (Outwards) and under Local Purchases, you can view the transaction under Domestic Purchases - Designated Zone and the input tax credit claim under Reverse Charge

For more details, you may refer our step-by-step guide on Reverse Charge Mechanism on Electronic Devices in TallyPrime.