- GCC VAT implementing States

- Export of goods to GCC VAT implementing States

- How to Get Started with GCC VAT using TallyPrime

In our previous article, we have learnt about the VAT treatment of export of goods to non-GCC VAT implementing States. Let us now understand how to treat the export of goods to GCC VAT implementing States.

GCC VAT implementing States

Currently, States which have implemented VAT in the GCC are UAE and KSA (Saudi Arabia). All the member states of the GCC which implement VAT are included in this category.

Export of goods to GCC VAT implementing States

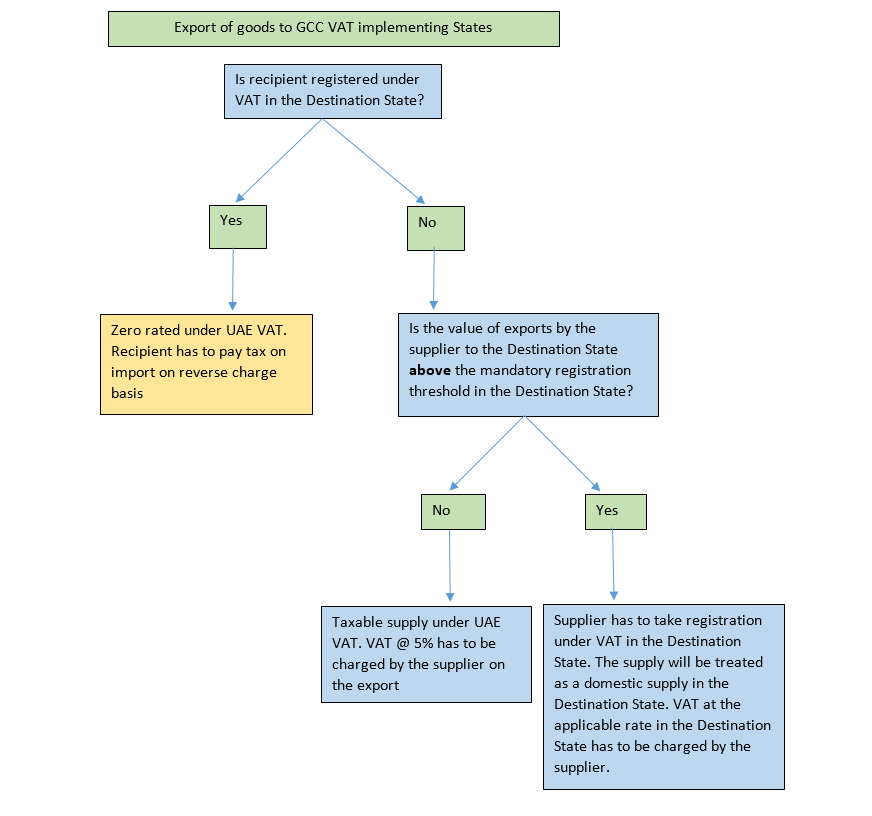

Export of goods to GCC VAT implementing States is treated differently from export to non-GCC VAT implementing States. While export to non-GCC VAT implementing States is zero rated under UAE VAT, provided the required conditions are met, VAT on the export of goods to GCC VAT implementing States depends upon 2 factors. These are:

- Is the recipient registered under VAT in the destination State?

- If the recipient is unregistered, is the value of exports by the supplier to the destination State below the mandatory registration threshold in the destination State?

Let us understand this with the help of the following diagram:

Let us understand this with examples.

Example: Noor Electronics LLC, a registered dealer in Abu Dhabi, supplies 50 mobile phones to a registered dealer, Abdul Electronics LLC, in KSA (Saudi Arabia).

Here, Abdul Electronics LLC is a registered dealer in KSA.

Hence, for Noor Electronics LLC, this is a zero rated supply under UAE VAT. Abdul Electronics has to pay tax on import of the mobile phones under reverse charge in KSA.

Example: Noor Electronics LLC supplies 50 mobile phones to a business, Ali Electronics, in KSA. Ali Electronics is not registered under VAT in KSA.

Here, Ali Electronics is not registered under VAT. Hence, the value of exports by Noor Electronics LLC to KSA during the year needs to be checked. Noor Electronics LLC has made exports of value SAR 250,000, which is below the mandatory registration threshold of SAR 375,000 in KSA.

Hence, Noor Electronics LLC has to charge VAT @ 5% on the export of mobile phones.

Example: Noor Electronics LLC, supplies 50 mobile phones to a business, Ahmed Enterprises, in KSA. Ahmed Enterprises is not registered under VAT in KSA.

Since the recipient, Ahmed Enterprises is not registered under VAT in KSA, the value of exports by Noor Electronics LLC, to KSA during the year needs to be checked. In the year, Noor Electronics LLC has made exports of value SAR 380,000, which exceeds the mandatory registration threshold of SAR 375,000 in KSA. This requires Noor Electronics LLC to take a VAT registration in KSA.

Hence, the supply of mobile phones by Noor Electronics LLC will be treated as a domestic supply in KSA and VAT @ 5% has to be charged by Noor Electronics LLC under KSA VAT.

In conclusion, the levy of VAT on the export of goods to GCC VAT implementing States depends upon the factors discussed above. Exporters in UAE need to be aware of these rules and levy VAT according to the scenario of export.

How to Get Started with GCC VAT using TallyPrime

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT, UAE Exports of services to outside the GCC Territory, Exports of Goods from UAE to Non-GCC VAT Implementing States

VAT Calculator

VAT Calculator, How to calculate VAT under Profit Margin Scheme

FAQs on VAT

VAT FAQs on Education Sector in UAE, VAT FAQs on supply of real estate in UAE, VAT FAQs on implementing VAT in your business, VAT FAQs on Zero Rate and Exempt Supplies in UAE, VAT FAQs on UAE Free Zone, VAT return FAQs