Taxable Income:

₹ 0

Base Tax :

₹ 0

Cess (4%) :

₹ 0

Surcharge :

₹ 0

Total Tax Payable :

₹ 0

After-Tax Income

Using the tax calculator for business income is simple and hassle-free.

Enter your Taxable Income in the input field.

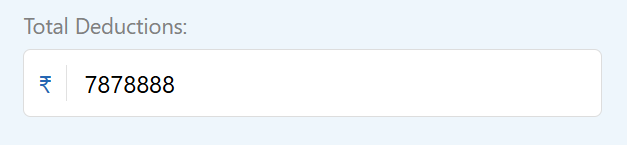

Add the total deductions amount here.

Select the Applicable Tax Rate from the dropdown.

Click Calculate to view your tax liability instantly.

| Income | Turnover does not exceed INR 4 billion in financial year (FY) 2023/24 | For other domestic companies | Foreign companies having permanent establishment (PE) in India | |||

|---|---|---|---|---|---|---|

| Basic | Effective* | Basic | Effective* | Basic | Effective* | |

| Less than 10 million Indian rupees (INR) | 25 | 26.00 | 30 | 31.20 | 35 | 36.40 |

| More than INR 10 million but less than INR 100 million | 25 | 27.82 | 30 | 33.38 | 35 | 37.13 |

| More than INR 100 million | 25 | 29.12 | 30 | 34.94 | 35 | 38.22 |

Knowing your tax liability helps allocate resources efficiently and avoid last-minute surprises.

Timely tax calculations ensure you meet advance tax deadlines, avoiding penalties for underpayment.

Early calculations highlight areas where you can claim deductions, reducing your tax liability legally.

Taxable Income ₹100,000

Tax ₹18000

After-Tax Income ₹82000

From invoicing to expense tracking, TallyPrime keeps your financials in order so you’re always prepared—whether it’s for audits, filings, or smarter decision-making.

The calculator is designed for businesses looking to estimate their tax liability based on their taxable income and applicable corporate tax rate.

Yes, foreign companies with a presence in India can use the calculator by selecting the appropriate tax rate applicable to them.

Yes, TallyPrime is a complete business management solution that handles accounting, inventory, payroll, compliance, and insightful reporting—all in one platform.

TallyPrime not only ensures accurate and compliant tax filing but also grows with your business, making it a long-term, reliable partner in your financial journey.