- Contra Account Definition

- Contra Account Example and Format

- Types of Contra Account

- Importance of Contra Accounts

Contra Account Definition

An item on one side of an account that offsets fully or in part on the opposite side of the same account is technically referred to as a contra account.

Sounds too technical? Let’s make the contra account definition easier and simple with an example.

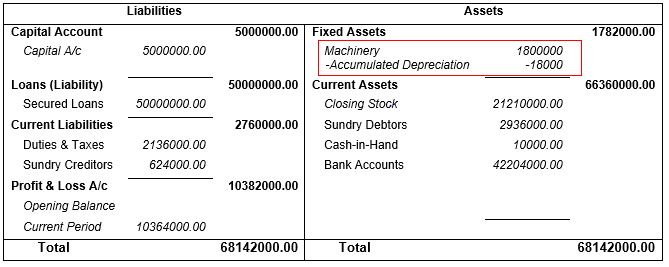

You might have seen in the balance sheet; all the accounts are shown at the net value after all the adjustments. Let’s say, the value of machinery is shown after reducing the depreciation from it. While there is nothing wrong here, there is also another way you could represent it i.e. show the full value of machinery (cost) in the balance sheet and then reduce the depreciation amount.

For you to represent these details in the balance sheet, you need a contra account. Only by using this account, you can offset the respective asset account that is paired in the balance sheet. In the above example, accumulated depreciation is a contra account of machinery.

Both ways of accounting will have the same impact but the later one will give you more information such as purchases cost of machinery; how much depreciation is written off etc.

Now that you have understood the contra account definition, you can summarize that contra account will always have a credit balance that will offset with paired asset account. In simpler words, contra account always has a negative balance to offset with paired asset account and shows the net balance of asset account in the balance sheet.

Contra Account Example and Format

Ace and Co. purchased machinery for 18,00,000. The estimated life of the machinery is 10 years and every year, 10% of the value is written off as deprecation (Straight-line method).

For you to show the deprecation in the balance sheet, you need a contra account that will hold the accumulated value of depreciation and latter, offset with the machinery account. Here ‘Accumulated Depreciation’ is a contra account and the following are the journal entries to be recorded in the books of accounts for the first year to account for depreciation.

Dr Depreciation Expenses 18,000

Cr Accumulated Depreciation 18,000

Balance Sheet with Contra Account for 1st Year

Similarly, for the remaining 9 years, the depreciation is accounted in contra account, and in the 10th year, the net value of machinery will be ‘0’ since it is completely written off. The following will be the journal entry to be recorded in the books of accounts to write off the asset.

Dr Accumulated depreciation 18,00,000

Cr Machinery 18,00,000

Types of Contra Account

Contra Asset Account

An asset account usually carries a debit balance, so a contra asset account carries a credit balance. This includes an allowance for doubtful accounts and accumulated depreciation.

Creating allowances for doubtful accounts represents the percentage of accounts receivable a company believes it cannot collect. Such allowance for doubtful accounts offsets a company’s accounts receivable account.

Accumulated depreciation offsets a company’s real property assets, such as buildings, equipment, and machinery. This represents the cumulative amount of depreciation expense charged against an asset. Accumulated depreciation reduces the value of an asset.

Contra Liability Account

Liabilities typically carry a credit balance. The example for contra liability accounts includes, discounts on bonds payable and a discount on notes payable which carry normal debit balances.

The upright discount on bonds payable represents the difference between the amount of cash a company receives when issuing a bond and the value of the bond at maturity. This reduces the value of a bond.

Notes payable or bills payable represents a liability created when a company signs a written agreement to borrow a specific amount of money. The granter may offer the company a discount if it repays the note early. The discount reduces the total amount of the note to reflect the discount given by the granter.

Contra Equity Account

An equity Contra account reduces the total number of outstanding shares listed on a company’s balance sheet.

Treasury stocks represent a contra equity account. When a listed company buys back its own shares from the open market, it records the transaction by debiting the treasury stock account. A company may take the decision to buy back its shares when management feels the stock is undervalued or because it desires to pay stock dividends to its shareholders.

Contra Revenue Account

The contra revenue accounts commonly include sales returns, sales allowance, and sale discounts. Such contra account carries a debit balance and reduces the total amount of a company’s revenue.

The amount of gross revenue minus the amount recorded in the contra revenue accounts equals a company’s net revenue. Such an entry is made under the sales return account when a customer returns a product to the company.

Providing sales allowance represents discounts given to customers to entice them to keep products instead of returning them. For example, slightly defective items are sold with a discount.

Discount on sales account represents the discount amount a company gives to customers as an incentive to purchase its products or services.

Importance of Contra Accounts

A contra account always offsets the balance of a corresponding account. Any entry made to contra accounts is presented on a company’s balance sheet under the paired account.

The contra accounts in the balance sheet help the users of the financial statement to get complete information. If the values are reported at net value, the users may not able to see how each of the elements has performed over the years. Let’s consider the above example of machinery, if it is reported at net value (after reducing depreciation), a user may not be in a position to know the purchase cost of the machinery; how much depreciation is written off, etc.