Tally Solutions | Updated on: May 13, 2021

What is a VAT Group Registration?

In UAE VAT Registration, two or more persons conducting businesses may apply for Tax Registration as a tax Group. A tax group is a group of two or more persons registered with the FTA as a single taxable person subject to fulfilment of conditions under UAE VAT Law. This group registration is only for the purpose of tax.

Conditions for Applying VAT Group Registration

To be eligible for applying for VAT Group registration, all of the following conditions need to be fulfilled.

Each person shall have a place of establishment or fixed establishment in the State:

This implies that each person should have either of the below-mentioned establishments in UAE :

- Place of Establishment: The place where a business is legally established in UAE pursuant to the decision of its establishment, or a place in which significant management decisions are taken and central management functions are conducted.

- Fixed Establishment: Any fixed place of business, other than the place of establishment, in which the person conducts his business regularly or permanently and where sufficient degree of human and technology resources exist which enables the person to supply or acquire Goods or Services. This includes branches, which are also considered as the fixed establishment.

The relevant persons shall be Related Parties:

Here related parties refer to two or more persons who are not separated on the economic, financial or regulatory level, where one can control others either by Law, or through the acquisition of shares or voting rights.

One or more persons conducting business in a partnership shall control the others:

This implies that one or more person who are related, controls the other business. For example, officers or directors of one another's businesses, partners in each other's business etc.

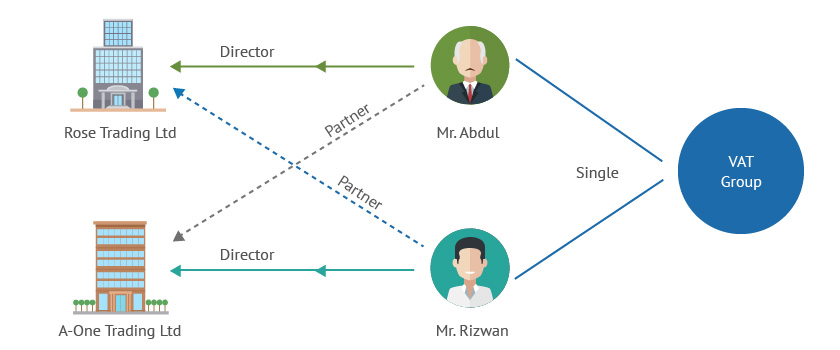

VAT Group Registration Illustration

As illustrated above, Mr Abdul is a Director in Rose Trading Ltd and a Partner in A-One Trading Ltd. Mr Rizwan, is a Director of A-One Trading Ltd. Also, Mr. Rizwan is a Partner in Rose Trading Ltd. Therefore, Mr Abdul and Mr. Rizwan will be treated as related parties and will be eligible to apply for VAT Group Registration provided the conditions are fulfilled.

VAT Group Registration Benefits

The following are the benefits of VAT Group Registration for the business

- All the entities within a VAT Group will be treated as 'ONE' entity for VAT purpose. This will help the businesses in simplifying accounting for VAT, and also compliance reporting like VAT returns are required to be prepared and reported at the group level instead of entity level.

- Any supplies within the entities of a VAT group, are out of the scope of the VAT. This means, VAT will not be levied on the supplies between the entities of a VAT Group. However, supplies made by the VAT group to an entity outside the VAT group are subject to VAT.

Latest Blogs

Maximising Tax Benefits for Free Zone Entities under UAE Corporate Tax Law

Key Dates for Phases and Waves of e-Invoicing Compliance in KSA

Simplifying VAT Compliance for Financial Institutions Using SWIFT Messages in UAE

Simplifying Arabic Invoice Compliance in Kuwait and Qatar with TallyPrime 5.0