- What is the billing cycle in invoicing?

- How does a billing cycle work?

- Examples of a billing cycle

- How Tally Solutions help in Billing Software

Many of us may expect our credit card, phone, internet and other bills at the end of the month. In some places, utility bills may be sent every two months. This interval between each bill and the next is called the billing cycle. Though most businesses enforce a monthly billing cycle, this may be different from business to business. Some businesses may have a weekly billing cycle. It is important that the accountant be able to work with different billing cycles for different companies or for different products and services within the same company. The statements or bills should be generated at the same interval specified by the billing cycle.

|

Outsourced Bookkeeping: Everything You Need to Know to Find a Bookkeeper Software |

What is the billing cycle in invoicing?

In a business, the time between one billing statement and the next one is called the billing cycle. A billing cycle is only applicable to a recurrent service or product that is consumed by the customer. It is possible for different companies to have different billing cycles. There may also be different billing cycles for various products within the same company. Some companies may allow the customer to set their preferred billing cycle. The most popular billing cycle that is used by businesses is the monthly billing cycle. It is important to negotiate and fix how long is a billing cycle for each customer. The accounts department will generate a bill at the agreed upon interval.

How does a billing cycle work?

Types of billing cycles

The most common application of the term billing cycle refers to bills such as credit card bills, utilities and recurring subscription fees. There are two ways in which a billing cycle works. For example, let us consider an internet service provider with a monthly billing cycle. They could charge a customer based on the data that they joined. So, if the customer started availing services on the 15th of a month, the billing cycle could be every 15th of the month. But, if the service provider bills every calendar month, all customers would get a bill at the end of the month regardless of when they had signed up for the services. The person who joined on the 15th would be billed for half a month in the first billing cycle.

In the first example, the billing cycle is different for each customer and the company would be sending out bills and collecting payment through the month. In the second example, all the customers are billed at one time at the end of the month and the bill collection is usually made before the last date that the bill is due.

The first method spreads out the billing process through the month, but there is an inflow of payments month long. It increases the administrative burden of generating and sending bills and following up for collection. A billing software such as Tally makes this task much easier by automating the billing process and generating reports that helps keep track of outstanding dues.

The second billing method is easier to follow up because all the bills will be due by a fixed date. However, generating so many bills may be a challenge without the right tools. In this case also, Tally makes work easier.

Grace period/pay by date

Most bills are issues with a grace period specified by when the bill has to be paid. This may range from 10 to 15 days. If the customer does not pay by the set date, there may be a termination of services or there may be penalties levied for late payment. In the case of a credit card or any other such finance related dues, late payment may also attract interest charges.

The billing cycle and grace period for payment are usually mentioned when the customer signs up for a service.

Billing details

The level of detail that is required in a bill depends on the service or product. If the service or product is a subscription, the bill may simply state the amount for a month. But certain bills such as a credit card bill may list out every individual transaction and item on the bill. The bill would also list the taxes, interest or other charges as applicable. The type of bill is entirely at the discretion of the biller as per their terms and conditions.

Payment date

The billing cycle will mean that the bill is generated on the date as per the cycle. But, the payment date is most often a date that is a few days after the billing date. So, the billing cycle and the payment cycle may not coincide at the same date though one precedes the other.

How long is a billing cycle

Sometimes, the billing cycle may be less frequent or more frequent than the norm. A magazine that offers annual subscriptions may offer a quarterly subscription scheme to attract new readers. A company that uses the services of an internet provider may find a monthly bill a hassle to pay and may request a quarterly billing cycle. This may be provided based on the credit worthiness of the company.

Examples of a billing cycle

Let us take the example of a person who subscribed to the local newspaper in the middle of the month. The customer has to pay a monthly subscription and the newspaper is delivered everyday. If the billing cycle ends at the month end, the customer would be billed for the number of days since he joined for the first bill. Thereafter, his bill would be generated for the entire month and the end of the month. If the billing cycle depended on the date of joining and he had joined on the 20th of the month, his bill would be generated on the 20th of every month. The customer may be given 10 days after the bill generation to make payment. So, for the end of the month billing cycle, the bill would have to be paid by the 10th of the next month. And for the bill generated on the 10th of every month, the pay by date would be the 30th. A regular billing cycle makes it easier for the customer to plan and clear their dues on time and for the business to keep track of defaulters.

How Tally Solutions help in Billing Software

As we have seen above, there is no single billing solution that fits all companies. Even within the same business, there may be different customers, products and services with different billing cycles. This may become a hassle to keep track of if the accounts are maintained manually or on a very basic accounting software. Tally billing software allows you to create billing cycles that are aligned to exactly how your company bills the service and how long is a billing cycle is. It is flexible enough to adapt to the peculiarities of the billing cycles offered for individual customers and products.

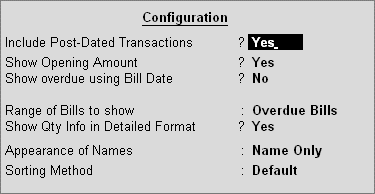

Tally-Configuration Of Overdue Receivables Report

Tally-Configuration Of Overdue Receivables Report

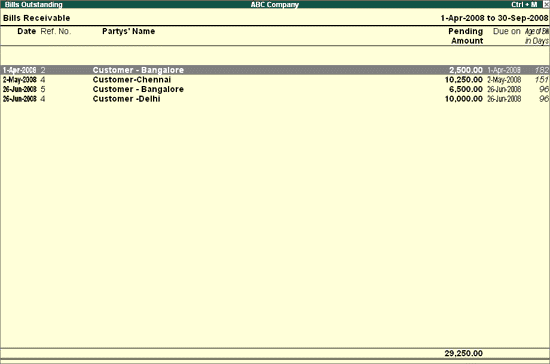

Tally also makes it easy to generate bills promptly and to keep track of the grace period, payments and overdue bills. Any penalties or charges that are applicable to defaulters can also be instantly applied. The overdue receivables feature gives you a birds eye view of all the overdue bills and their details. It can handle post dated transactions, part payments and other exceptions easily.

Tally-Overdue Receivable Report

Tally-Overdue Receivable Report

Tally is an intelligent billing software solution that enables you to quickly zip through bill generation and the resulting follow up of defaulters effortlessly. Whether you are a regular business or a subscription based service provider, check out Tally’s billing solutions and make your billing process quicker and more efficient.

Read More:

- Factors to Consider before Buying Bookkeeping Software for Your Business in USA

- Best Billing Software In USA – Things To Look Up Before Purchasing A Billing Software

Explore more Products