- What is a consolidated balance sheet?

- Format and example of consolidated balance sheet

- How do businesses prepare consolidated balance sheet?

What is a consolidated balance sheet?

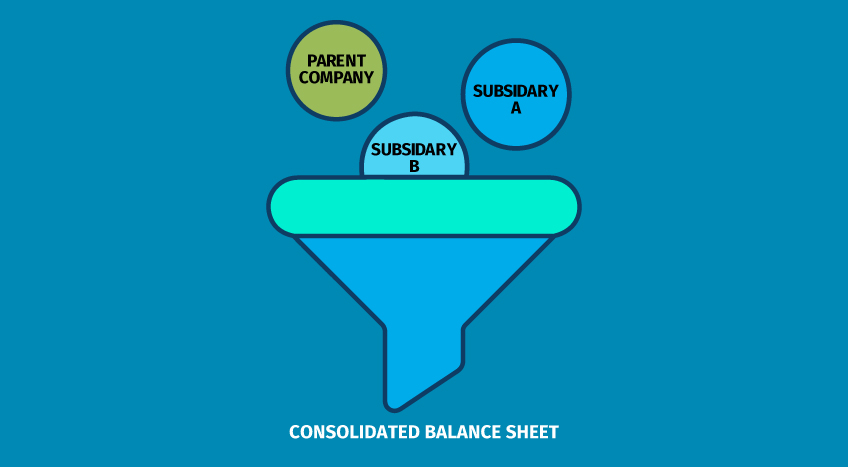

A consolidated balance sheet is a financial statement that shows the financial position of a parent company and its subsidiary companies. In simple words, a consolidated balance sheet is mere consolidation of financial details of all a subsidiary including the parent company and presenting as one balance sheet for the entire group.

A consolidated balance sheet is usually prepared by the business operating as a group of companies that have more than one subsidiary and it portrays the combined details of assets and liabilities.

Format and example of consolidated balance sheet.

P Ltd acquired Q Ltd on 1.1.2018. Their balance sheet as at 31.3.2017 is given below. Using this, let us prepare a consolidated balance sheet.

P Ltd Balance Sheets as at

31st March 2017

|

Liabilities |

P Ltd ( INR ) |

Assets |

P Ltd ( INR ) |

|

Share Capital : 10,000 Equity shares of Rs 10/- each fully paid 5,000 Equity shares of Rs 10/- each fully paid |

1,00,000

- |

Fixed Assets Investments : 4,000 Shares in Q Ltd |

80,000

40,000 |

|

General reserve |

40,000 |

Stock |

20,000 |

|

Profit and Loss Account |

20,000 |

Debtors |

25,000 |

|

Creditors |

10,000 |

Cash and Bank |

5,000 |

|

|

1,70,000 |

|

1,70,000 |

Q Ltd Balance Sheets as at

31st March 2017

|

Liabilities |

Q Ltd ( INR ) |

Assets |

Q Ltd ( INR ) |

|

Share Capital : 10,000 Equity shares of Rs. 10/- each fully paid 5,000 Equity shares of Rs. 10/- each fully paid |

-

50,000 |

Fixed Assets Investments: - 4,000 Shares in Q Ltd |

45,000

- |

|

General reserve |

10,000 |

Stock |

10,000 |

|

Profit and Loss Account |

10,000 |

Debtors |

10,000 |

|

Creditors |

5,000 |

Cash and Bank |

10,000 |

|

|

75,000 |

|

75,000 |

Consolidated Balance Sheet P Ltd and it is Subsidiary Q Ltd

As at 31.12.2017

How do businesses prepare consolidated balance Sheet?

A consolidated balance sheet is a key financial statement in the case of group companies. The financial statements of different companies belonging to the same group are consolidated to present the financial position as a whole.

Manually preparing a consolidated balance sheet involves several steps right from arriving at the share capital, profits, etc. and it is a tedious task. As a result, businesses have automated the task of consolidating financial information using accounting software. Thereby, a consolidated balance sheet is readily available when required. Not just consolidated balance sheet but also several other key financial and accounting reports can be consolidated with a click of a button.

Using TallyPrime, you can consolidate the entire books of accounts, view consolidated reports and seamlessly compare the parent and subsidiary companies' reports.

In TallyPrime, you can do this by creating a group company. It allows you to conveniently view all your companies in one place.

Group company creation in TallyPrime

Group company functions as a single economic entity, where financial reports such as balance sheet, profit and loss a/c, and trial balance are consolidated without any impact on the transactions and real-time basis.

Using the group company, you can compare the performance of your subsidiary companies and keep a tab on the overall business.