- What is bank reconciliation statement (BRS)?

- Why bank reconciliation statements are prepared?

- When does a business prepare bank reconciliation statement?

- How to prepare a bank reconciliation statement?

- Bank reconciliation statement (BRS) format

- Benefits of using accounting software for preparing BRS

- How Tally can help you in preparing bank reconciliation statement

What is bank reconciliation statement (BRS)?

Bank reconciliation statement is a report or statement prepared by the business to match the bank transactions recorded in the books of accounts with the bank statement. The bank reconciliation statement helps to check the correctness of the entries recorded in the books of accounts and thereby, ensures the accuracy of bank balances.

Why bank reconciliation statements are prepared?

With the definition of a bank reconciliation statement, you might be wondering why bank transactions recorded in the books of accounts do not match with the bank statement? There are plenty of reasons and some the common ones are listed below:

- Cheques Issued but not cleared in the bank

- Difference in cheque deposited and cheque credited date

- Date of cheque issued towards payment and date on which it is debited is different

- Cheque issued or received is not presented to the bank for clearing

- Bank interests, charges etc. are not accounted for. Reason being it is not known till you reconcile.

- Banks can also do mistake in debiting or crediting the transactions

- Just like banks, you too can make mistake in accounting the bank transactions in books of accounts and so on….

Due to the reasons listed above, the closing bank balance in your books of accounts and actual bank balance as per bank will not match. This means, the bank balance what you think you have it your bank is not the one available in the bank. Deciding basis the book balance will put you in an uncomfortable situation.

To avoid those situations, bank reconciliation statements are prepared. This statements simply matches the bank transactions as per company books with bank statement so that you always have accurate bank balance reflecting in the books of accounts.

When does a business prepare bank reconciliation statement?

Depending on the volume and value of bank transactions, the reconciliation activities are carried out daily, weekly, fortnightly etc. If the volume or value of transactions is higher, the reconciliation activities are carried on daily to mitigate the risk of payment/cheque bounce.

How to prepare a bank reconciliation statement?

Bank reconciliation statement (BRS) involves the process of identifying the transactions individually and match it with the bank statement such that the closing balance of bank in books matches with the bank statement. For one which is not matched, suitable adjustments or correction will be done in the book to match it.

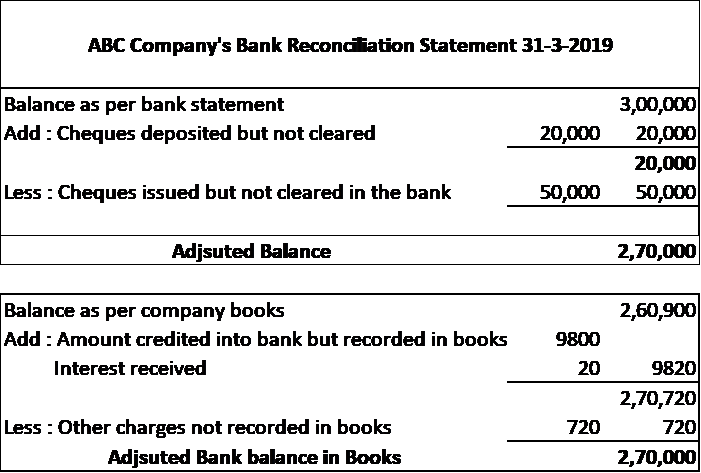

Bank reconciliation statement (BRS) format

Benefits of using accounting software for preparing BRS

Comparing the two statements with a long list of transactions is stressful and error-prone using the manual and conventional method of bank reconciliation.

The only way to overcome this is to ‘automate’ the bank reconciliation process using accounting software. It saves time and effort in day-to-day operations. More importantly, you get accurate and near real-time information on bank balance in books of accounts.

Here, automating bank reconciliation is nothing but using accounting software to record the business transactions including the bank transactions such that the bank reconciliation statements are automatically prepared. Also, accounting software will help you automatically reconcile the bank statements with minimum efforts.

The following are benefits of automating the bank reconciliation process using accounting software.

- Easy to reconcile: Using an accounting software will help you to prepare a bank reconciliation statement automatically and reconcile with minimum efforts.

- Saves time and efforts: No matter whether there are 50 or 500 transactions, the efforts and time to reconcile is the same. Since it is reconciled automatically, you will save a lot of time and efforts involved reconciling the bank transactions.

- Detecting unaccounted transactions is easier: Get to know the new transactions(unaccounted) like bank charges or bank interests etc. and easily account and reconcile.

How Tally can help you in preparing bank reconciliation statement

Tally’s auto bank reconciliation is designed to perform the bank reconciliation exactly in the same way you use to do it manually. To manually reconcile, you need to match the transaction amount and instrument number with the bank statement. TallyPrime, an accounting software exactly mimics the way you used to manually reconcile but the only change is, it is automated for you.

TallyPrime‘s auto bank reconciliation will minimize the time spent and the risk of errors during bank reconciliation. Auto bank reconciliation in TallyPrime provides a simple and no-frills method of reconciling your company bank books with the bank statement.

Using this option, you just need to import the e-statement you received from the bank to TallyPrime (in Excel, delimited, CSV format) and hit the reconcile button. You are done.

TallyPrime also shows you complete detail of any unaccounted transactions, like bank charges or bank interests etc. and help you easily account those transactions from the same screen.

It's quick, simple, accurate and stress-free. It saves your time, manpower and money.

Click Here to know TallyPrime can help you manage banking needs effortlessly.