SHARE

Tally Solutions | Updated on: April 22, 2022

- What are financial accounting standards?

- Why are financial accounting standards important?

- What are the accounting standards in Indonesia?

- Tiers of accounting principles in Indonesia

- Accounting software for Indonesian businesses

What are financial accounting standards?

Financial accounting standards are the principles that govern accounting. Each country has its accounting standards board that defines the accounting standards to be followed by businesses that operate in that country. Financial accounting standards form a foundation that ensures all businesses comply with those principles and policies. The financial accounting standards also ensure that a set of practices are followed by all businesses which allow for easy comparison between two or more businesses. When these accounting standards are being applied, they are done so for all types of business financials including shareholders equity, liabilities, and revenue.

Financial accounting standards consist of a set of principles

Why are financial accounting standards important?

Entities such as investors and banks benefit from accounting standards as they help them ensure the relevance and preciseness of the financial information of businesses. Financial accounting standards ensure that businesses are transparent when they report their financial reports. It brings in uniformity as it lays a foundation of how financial information needs to be reported in that country. That is, it also makes it clear how financial information should be recorded and presented so that comparisons can be easily made across different businesses. It ensures consistency to make it efficient for different entities to understand financial information.

What are the accounting standards in Indonesia?

Just like the rest of the world, Indonesia has a financial accounting standards board. The Indonesia Financial Accounting Standard Board (Dewan Standar Akuntansi Keuangan or DSAK) and the Indonesia Sharia Accounting Standards Board (Dewan Standar Akuntansi Syariah or DSAS) are two entities that issue the accounting standards in Indonesia called the Indonesian Financial Accounting Standards or PSAK. The DSAK and DSAS fall under the Indonesian Institute of Chartered Accountants or the Ikatan Akuntan Indonesia (IAI). These Financial accounting standards must be followed by both the public businesses and private companies that operate in Indonesia.

|

How Do You Evaluate the Cost Effectiveness of a Business Software? |

Why Is It Important to Choose A Software That Grows with Your Business? |

Tiers of accounting principles in Indonesia

There are four tiers of accounting principles in Indonesia as follows.

Tier 1 – PSAK based IFRS

This tier is for both domestic companies and foreign businesses. It is also for those companies which have public accountability.

Tier 2 – PSAK Syariah

This tier is for those companies which take into account the Syariah principle when they are conducting their financial transactions. This includes Syariah financial institutions.

Tier 3 – PSAK-ETAP

This tier is for those businesses that do not fall under public accountability and it outlines the standard that they can use for generating their financial statements.

Tier 4 – PSAK EMKM

This tier is for micro-businesses, small businesses, and enterprises.

Bookkeeping and financial year in Indonesia

In Indonesia, bookkeeping must be maintained by every business regardless of its size and industry. This includes the financial statement of the company and all the accounting records along with their documents. For example, vendor invoices, agreements, sales invoices, contracts, and so on must be stored in a safe place. These documents must be stored for 10 years. When it comes to the financial year, all Indonesian companies must submit their financial statements by 30th April next year. The financial year-end for Indonesian companies is the same as the calendar year which means 1st January to 31st December.

Which financial statements are important in Indonesia?

The following financial statements are important for businesses in Indonesia.

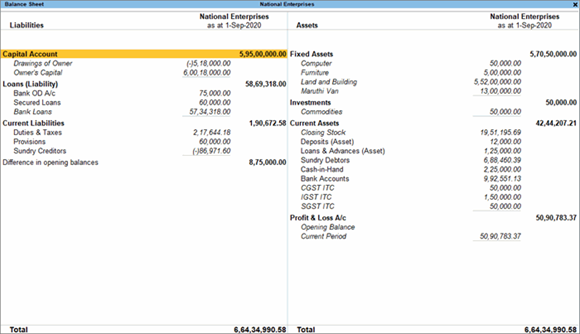

Statement of financial position or balance sheet

Also known as the balance sheet, businesses in Indonesia must have this financial statement. The balance sheet is important as it shows the financial position of the business at a point in time. It throws light on the liabilities as well as the assets of a business and the equity. The statement of financial position is particularly important to creditors, lenders, and investors.

Balance sheets are vital for businesses

Cash flow report

The cash flow report is another important financial statement that is given importance in Indonesia. It gives information about liquidity which means how much operating cash you have at hand. It also shows how much cash flow you can have in the future. Another important aspect the cash flow report can show is the change in equity, liabilities and assets.

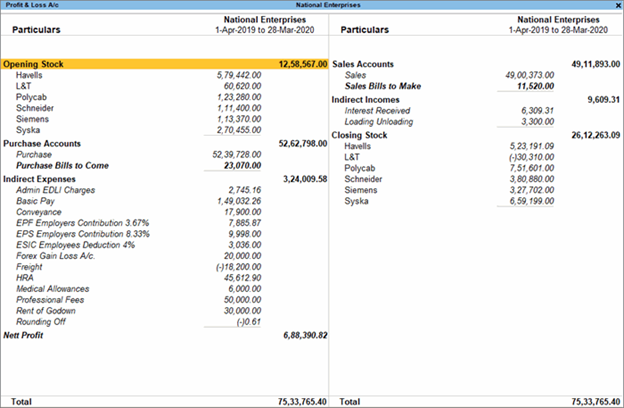

Profit & loss statement

The profit & loss statement is another important financial statement in Indonesia. P&L statements give you additional details about the financial health of businesses over a span. It can show you details of the earnings, operating costs, and revenue over a period of time. P&L statements show you if you are earning more than your expenditure in which case you can invest elsewhere in your company.

An example of P&L statement generated by TallyPrime

Statement of changes in company equity

While the statement of changes in equity isn’t considered the most important like the previous three, in Indonesia it is given importance because of the insights it can provide. While you cannot derive much value from the statement by itself, when you consider it in conjunction with the other financial statements, it can show what causes the losses and gains in equity over a period of time.

In Indonesia, all the financial statements must contain information about the previous years so that it is easier to determine how a business fared in comparison to the year before. This is recommended for all types of businesses. It is also mandatory for all the account-related records to be in Bahasa Indonesian. This is a standard procedure in Indonesia and every business must comply. It is standard to include notes too for better comprehension of all these reports.

Accounting software for Indonesian businesses

Businesses need to ensure they are always reporting their financial transactions accurately. Gone are the days when you had to rely on only bookkeepers. In today’s financial landscape, businesses must use accounting software Indonesia for unmatched precision. TallyPrime is a accounting software is solution for all business accounting requirements. It is one of the best and most advanced accounting software solutions that ensure you can generate complex reports. An accounting software solution greatly enhances business efficiency, lowers the time taken to generate insights, and provides better control over your finances so you never miss out on anything.

TallyPrime makes invoicing and accounting easy as you can create professional invoices, manage all your sales and purchases, and deal in multi-currency easily. The accounting software solution ensures effective inventory management. You can watch stock movements and understand the total cost of the stock at any given moment. This enables you to store enough stock without wasting space, money, and effort. The software comes with a bank reconciliation option that automatically reconciles ensuring your records are accurate as they can be. It also features other banking features that are of value to businesses.

The software tool offers payroll management to businesses which means you can manage the pay-outs for your employees with it. It provides the flexibility you need to manage payroll and ensure smooth payments to your employees on time. The credit and cash flow management feature of TallyPrime allows you better credit control along with enhanced capabilities to manage cash flow. It also provides an ageing analysis. TallyPrime is capable of providing a complete view of your financial situation through its reports feature that allows you to slice and dice for a better understanding of your business.

Explore more Products

Accounting Software, Inventory Management Software, Payroll Software, Financial Management Software, Invoicing & Billing Software, Business Software for Small Businesses & Start-ups

Read more about TallyPrime

What is TallyPrime?, TallyPrime’s ‘Go To’, Tally Prime’s Amazing Invoicing Experience, New Edit Log Feature in TallyPrime, Tally’s Exception Reporting to Address Data Anomalies, TallyPrime’s Simplified Security and User Management System, Multitasking Just Got Easier with TallyPrime, TallyPrime – Simple to learn and easier to use, 5 Things in TallyPrime for Enhanced Business Efficiency, 5 Things You Can Do Using Save View Option in TallyPrime

Read more about Business Software

Integrated Business Software Vs Separate Software Tool for Each Module, How Do You Evaluate the Cost Effectiveness of a Business Software?, Why is it Important to Choose a Software that Grows with Your Business?, 7 Questions That You Need to Ask for Selecting the Right Software for Your Business, Personalise the Business Reports the Way You Want, Business Entities in Indonesia

Latest Blogs

5 Must Have Reports Insights in Your Dashboard

Import Data from Excel to TallyPrime

All-New Simplified & Powerful Report Filters in TallyPrime

TallyPrime’s Flexible Voucher Numbering Capabilities for Accurate Recordkeeping