- What is e-invoicing?

- TallyPrime, the best e-invoice software in India

- Features of TallyPrime’s e-invoice solution

- How to generate e-invoice instantly in tallyprime?

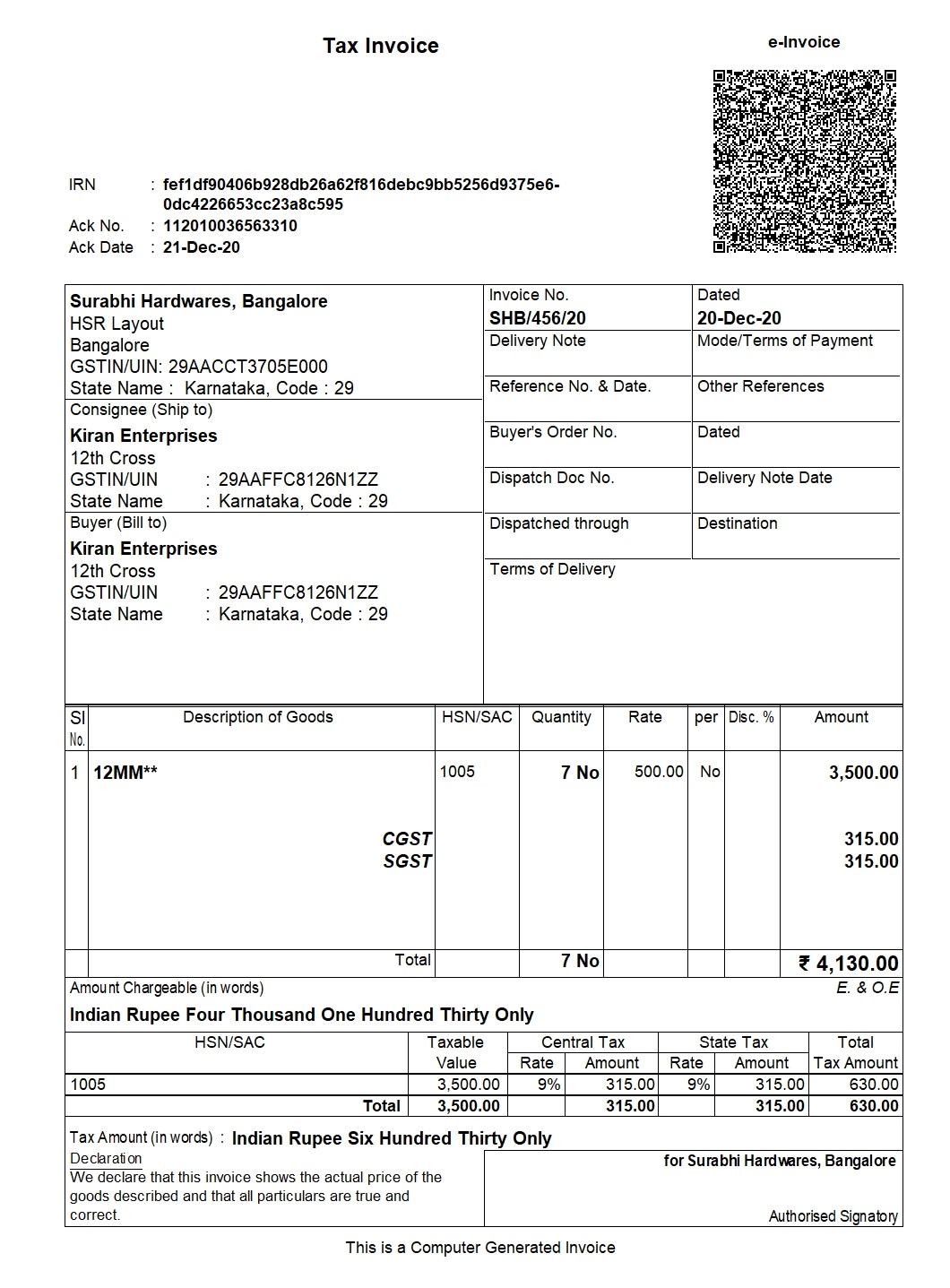

From generating e-invoices instantly to keeping track of them through the e-invoicing report and everything in between, TallyPrime takes care of every little detail to bring you the most delightful experience. It's so fast that just by saving the invoice, the IRN and QR code will be automatically added.

What is e-invoicing?

To give a brief, e-invoicing is the process of uploading all your B2B transactions (Sales, Credit Note and Debit Notes made to businesses, including all types of exports) on the IRP (invoice registration portal) for authentication. Once authenticated, the IRP will issue a unique IRN (Invoice reference number) for every invoice. A QR code will be added to the invoice along with the IRN.

TallyPrime, the best e-invoice software in India

For businesses to have a smooth transition to an e-invoicing software, it is extremely imperative that your business management software is integrated with the IRP portal. As you may be aware, Tally is a recognized GSP (GST Suvidha Provider) which ensures TallyPrime directly integrates with the IRP portal to generate e-invoices seamlessly.

- You can send your invoices through TallyPrime directly to the IRP

- Once they are authenticated by the IRP, TallyPrime will receive the IRN and QR code directly from the IRP and update your invoices accordingly. All this automatically

- You can then simply print the IRN and QR code on your invoice

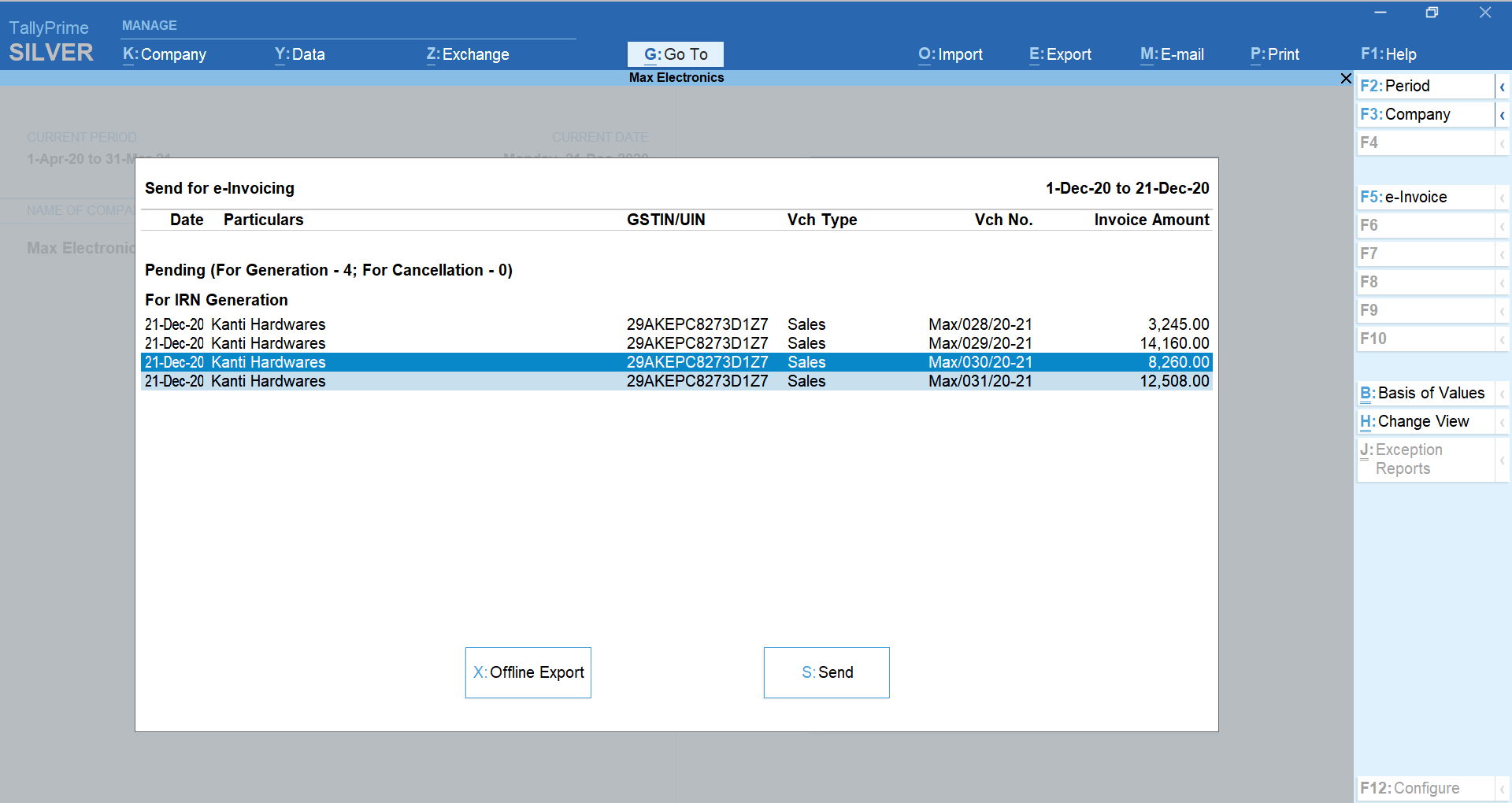

| Bulk Generation of e-Invoices in TallyPrime |

Features of TallyPrime’s e-invoice solution

We understand that this is a completely new experience and you will take time to get used to it. Moreover, you may be faced with different situations while needing to comply with e-invoicing norms. TallyPrime has therefore made the product extremely flexible so that the process is convenient and adapts to your comfort.

Here are some of the best features of TallyPrime’s e-invoicing solution that will take care of your needs seamlessly:

- Instant e-invoice

With TallyPrime’s fully connected e-invoicing solution, you can generate e-invoices instantly, with zero manual processes. Just record the invoice and print, TallyPrime will automatically add IRN and QR code.

- Single or bulk e-invoice

You can either generate an e-invoice in the flow of recording invoice or do this in bulk for multiple invoices together. TallyPrime will adapt to your preference

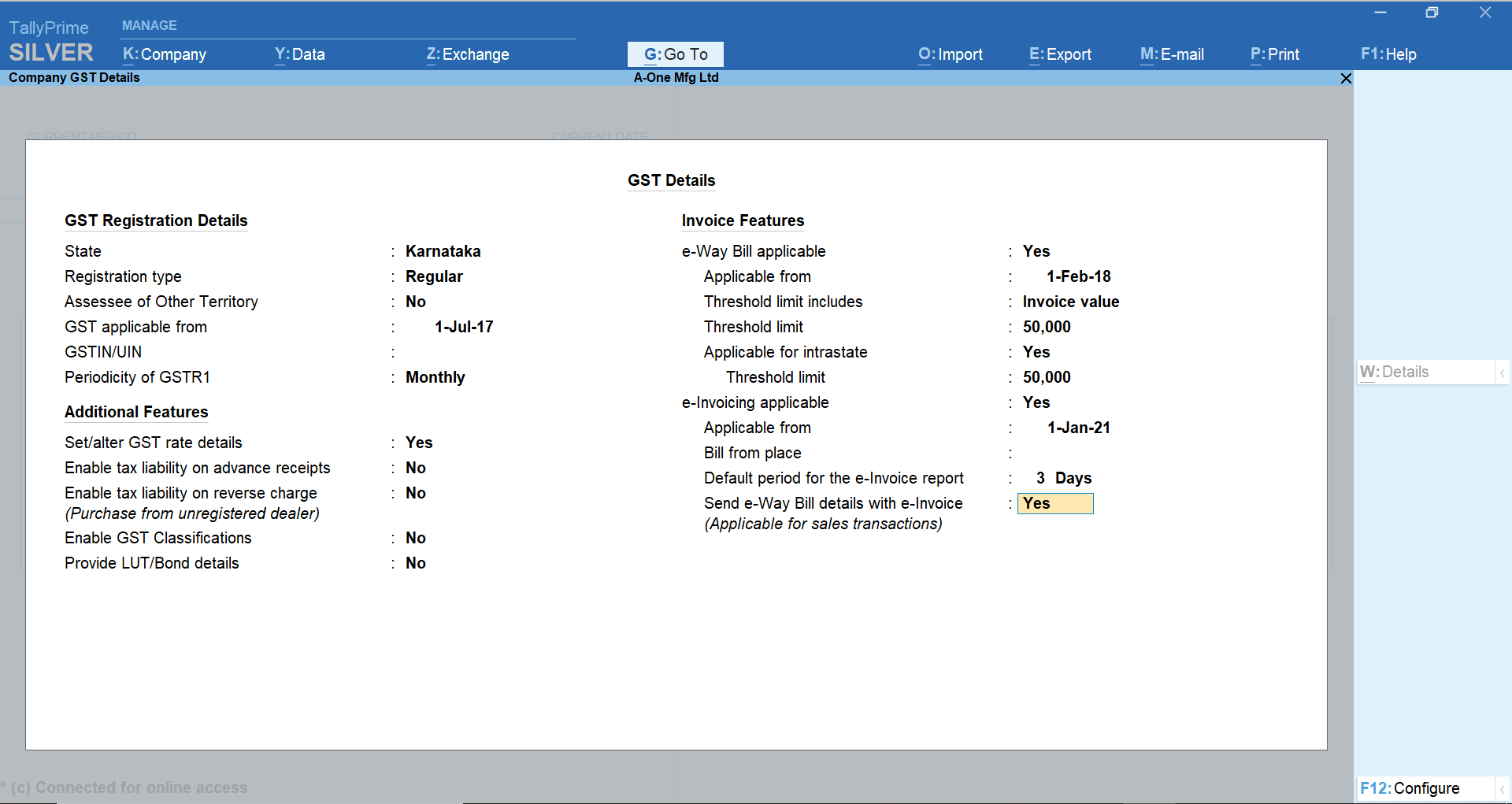

- e-invoice with e-way bill

If your supply requires an e-way bill, TallyPrime will automatically generate e-way bill in the process of getting e-invoice details.

- Online e-invoice cancellation

In those scenarios where an e-invoice needs to be cancelled, you can easily send the cancellation request from TallyPrime.

- Supports offline mode

It is quite possible that the system you normally use to generate e-invoice may get disconnected from the internet. In such a case, TallyPrime will help you handle the situation by exporting e-invoice-related data in the form of a JSON file

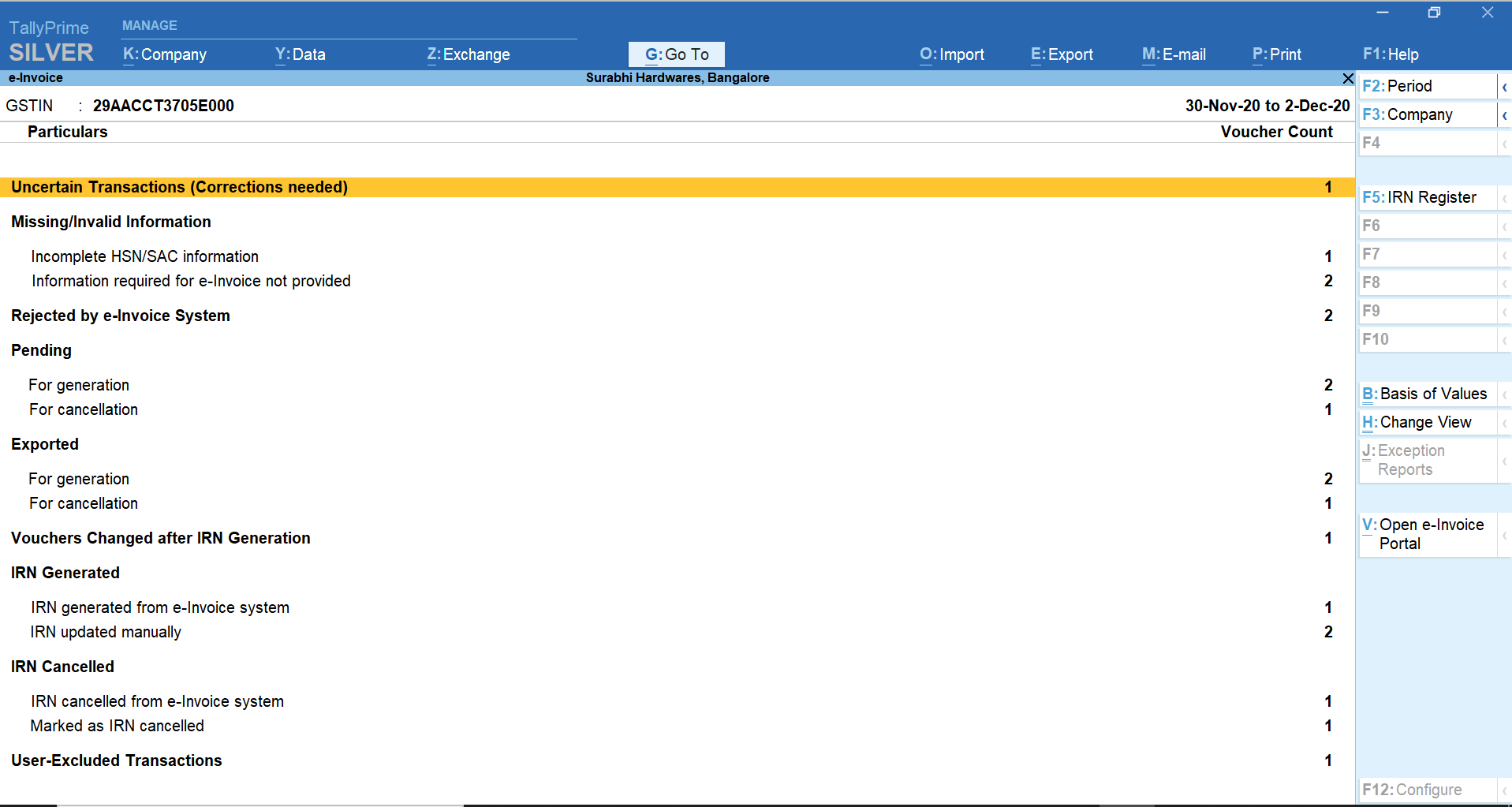

- e-invoice reports

TallyPrime’s exclusive report will give you a complete view of the status of your transactions with respect to e-invoicing. You can quickly get to the completed, pending, cancelled etc.

- Useful alerts

Useful alerts Alerts will be available in multi-user scenarios to prevent redundancy and ensure that the latest data is shared with e-invoice portal. Also, it helps you safeguard against accidental modification/deletion/cancellation of IRN generated for a particular transaction

How to Generate e-Invoice Instantly in TallyPrime?

Generating e-invoice with TallyPrime is extremely simple. With a one-time setup you can start generating and printing e-invoices within seconds. You wouldn’t need to change the way you work at all as TallyPrime adapts to your working style and gives you the flexibility to generate reports your way, in just 3 steps: Enable, record and print.

- First, enable e-invoicing applicable to ‘Yes’. Make E-way bill also to ‘Yes’, if applicable

- Record/pass a voucher entry like you usually do in Tally with all the relevant information and as soon as you accept the screen, you will be intimated with a message asking if you want to generate an e-invoice. The moment you select ‘Yes’, TallyPrime will exchange the relevant data with the IRP system and soon all the transaction details will be automatically updated on the IRP

- Below is the final e-invoice which you will receive along with the unique QR code and IRN.

Yes, it is that simple!

Enjoy truly connected e-Invoice experience with TallyPrime! Take a free trial today and be pleasantly surprised with our unmatched prevention, detection and correction capabilities.

Watch: How to Generate E-invoices Instantly in TallyPrime

FAQ

How to enable e-invoice in TallyPrime?

e-Invoice can be enabled in TallyPrime in three quick steps:

- Press Alt+G (Go To) > Alter Master > Voucher Type > type Sales > press Enter. Alternatively, Gateway of Tally > Alter > Voucher Type > type or select Sales > press Enter.

- In the Voucher Type Alteration screen for Sales, set Allow e-Invoicing to Yes.

- Press Y to accept the screen.

How do I make a quick e-invoice?

TallyPrime adapts to your working style and gives you the flexibility to generate reports your way, in just 3 steps: Enable, record, and print.

Know more about e-invoices in GST