Tally Solutions | Updated on: March 14, 2022

The VAT treatment of services supplied from Designated Zones is different compared to the supply of goods. Unlike the goods, which are VAT free when supplied between Designated Zones, the supply of services does not enjoy similar benefits. The reason being, the place of supply of services is considered to be inside the State of UAE if the place of supply is in the Designated Zone. This implies, that for any services supplied within the Designated Zone, the standard rate of VAT at 5% will be levied.

In this article, we will understand the VAT treatment on services supplied from the Designated Zone in the following scenarios:

- Services supplied from Designated Zone to another Designated Zone

- Services supplied from Designated Zone to Mainland

- Services supplied from Designated Zone to outside the UAE State

To know more about Designated Zones, please read VAT on Designated Zone and VAT on Free Zones in UAE.

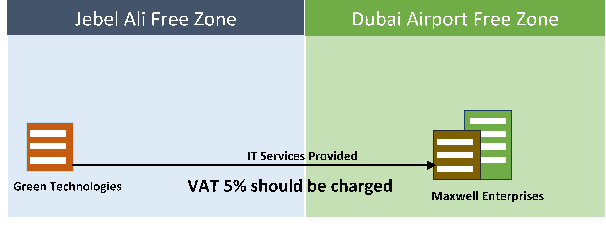

Services supplied from Designated Zone to another Designated Zone

Supply of services between Designated Zones is taxable at 5%. This is because, the place of supply for services supplied within the Designated Zone is considered to be within the State.

For example, Green Technologies, located Jebel Ali free zone, provided IT Services to Maxwell Enterprise, located in Dubai Airport Free Zone.

In the above illustration, Jebel Ali Free Zone and Dubai Airport Free zone are Designated Zones. The supply of services from Green Technologies to Maxwell Technologies will attract VAT at 5%.

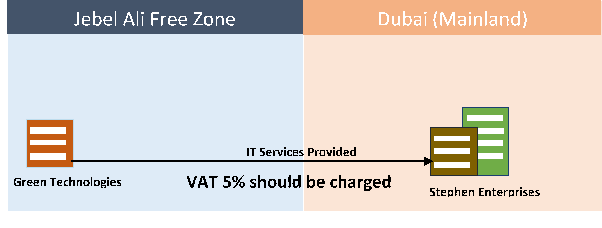

Services supplied from Designated Zone to Mainland

The supply of services from the Designated Zone to mainland (inside the State) are taxable and VAT at 5% should be charged on the supply of services.

For example, Green Technologies, located in the Jebel Ali free zone, provided IT Services to Stephen Enterprises, located in the Dubai mainland.

In the above illustration, Jebel Ali Free Zone and Dubai Airport Free zone are Designated Zones. The supply of services from Green Technologies to Maxwell Technologies will attract VAT at 5%.

Services supplied from Designated Zone to Mainland

The supply of services from the Designated Zone to mainland (inside the State) are taxable and VAT at 5% should be charged on the supply of services.

For example, Green Technologies, located in the Jebel Ali free zone, provided IT Services to Stephen Enterprises, located in the Dubai mainland.

In the above illustration, IT Services are supplied from Jebel Ali Free Zone (Designated Zone) to Dubai (mainland). The supply of IT Services from Green Technologies to Stephen Enterprises will be taxable and VAT at 5% need to be charged for such IT services.

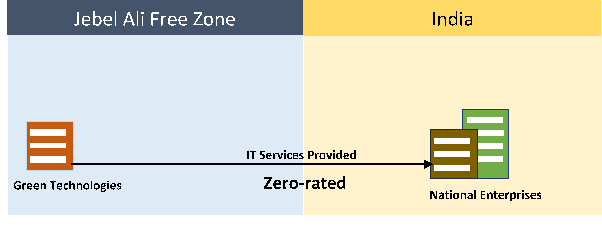

Services supplied from Designated Zone to outside the UAE State

Services supplied from Designated Zone to outside the UAE State will be considered as exports and will be zero-rated supplies.

For example, Green Technologies located in the Jebel Ali Free Zone supplied services to National Enterprises, located in India.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Invoice

VAT Invoice in UAE, Simplified Tax Invoice under VAT in UAE, What Consumers Must Check in a Tax Invoice in UAE, Checklist for a Tax Invoice under VAT in UAE, Date of Supply, Value of Supply and Invoice for Deemed Supply in VAT, How to issue a Tax Invoice to unregistered customers, How to issue Tax Invoice to registered customers, Tax Invoice under VAT in UAE

VAT on Supply

VAT on Supply of Charitable Buildings, VAT on supply of commercial property, VAT on supply of mixed use developments, VAT on supply of bare land

Latest Blogs

How to Register for Corporate Tax in the UAE

Late Registration Penalties in UAE Corporate Tax