Tally Solutions | Updated on: March 2, 2022

As a consumer in UAE, you are aware that VAT has been implemented in the country. You have also paid VAT on many purchases since then. However, there have been certain cases which have come to the fore now where suppliers have charged and collected VAT from consumers, though they are not authorised to do the same. As consumers, it is understandable that our knowledge of the intricacies of the VAT Law will be limited. However, you do not need to worry. With this simple checklist, you can ensure that you are receiving a genuine Tax Invoice for your purchase.

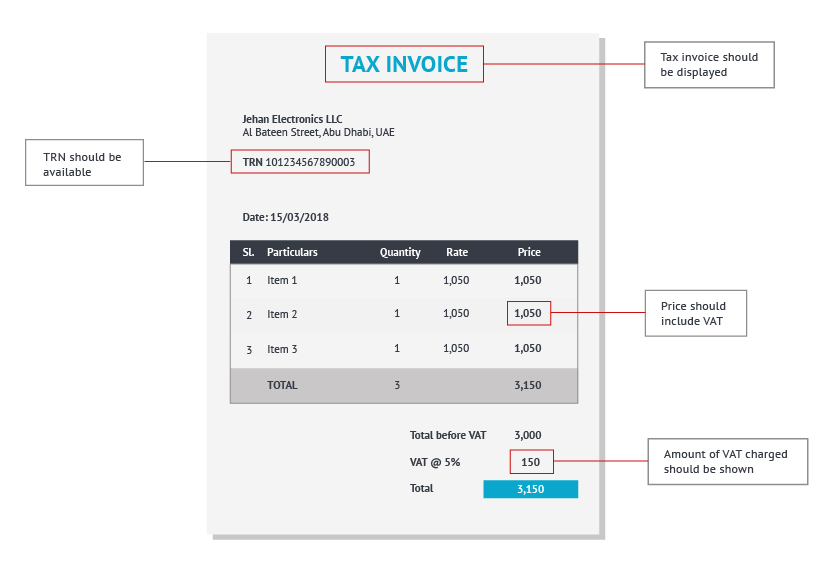

This can be a basic checklist for you to ensure that you are paying VAT to genuine suppliers. This, along with the provision for any person to verify the validity of a TRN, gives great power in the hands of consumers to ensure that they are not cheated.

Hence, these 4 things need to be checked by consumers when they receive invoices for their purchase. Note that a TRN (Tax Registration Number) is the identification number given to every registered business under UAE VAT. A business cannot charge VAT without being registered and holding a TRN. Additionally, in case you suspect that the TRN mentioned by the supplier is not true, you can verify its validity. We have explained the process for this in our article ‘How to verify whether a TRN is valid’. With these measures, you can ensure that you pay tax only to the businesses eligible to collect VAT.

Read more on UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Invoice

VAT Invoice in UAE, Simplified Tax Invoice under VAT in UAE, Checklist for a Tax Invoice under VAT in UAE, How to issue a Tax Invoice to unregistered customers, How to issue Tax Invoice to registered customers, Tax Invoice under VAT in UAE

VAT Registration

VAT Registration in UAE, How to link Tax Registration Number with Dubai Customs, How to Apply for VAT Registration in UAE, Is the Input VAT paid prior to Registration, claimable, Online Amendment or Change in Registration Details in UAE VAT, TRN, VAT Registration Deadlines in UAE, Who Should Register under VAT, How to de-register or amend a Tax Group under VAT in UAE, How to de-register under VAT in UAE, How to Register as a Tax Agent under UAE VAT, How to register as Tax Agency

FAQs on VAT

VAT FAQs on Education Sector in UAE, VAT FAQs on supply of real estate in UAE, VAT FAQs on implementing VAT in your business, VAT FAQs on Zero Rate and Exempt Supplies in UAE, VAT FAQs on UAE Free Zone, VAT return FAQs

Latest Blogs

How to prepare for UAE corporate tax filing?

How to Register for Corporate Tax in the UAE