Trusted by 2.5 million businesses globally

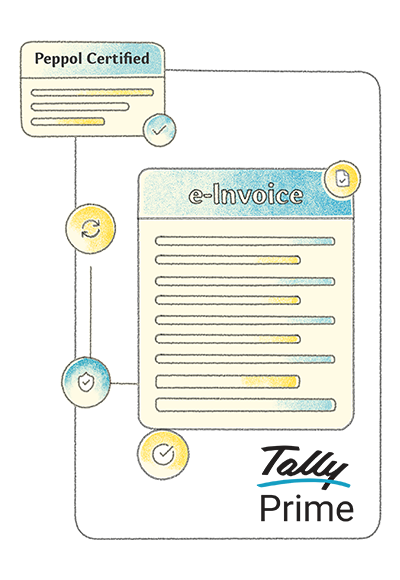

FTA Approved

VAT software

PEPPOL Certified

OpenPeppol Access Point

Pre-approved

ASP

TallyPrime e-Invoicing in UAE

What's Coming

FTA-approved invoice creation

Create invoices in line with UAE e-Invoicing requirements directly within TallyPrime.

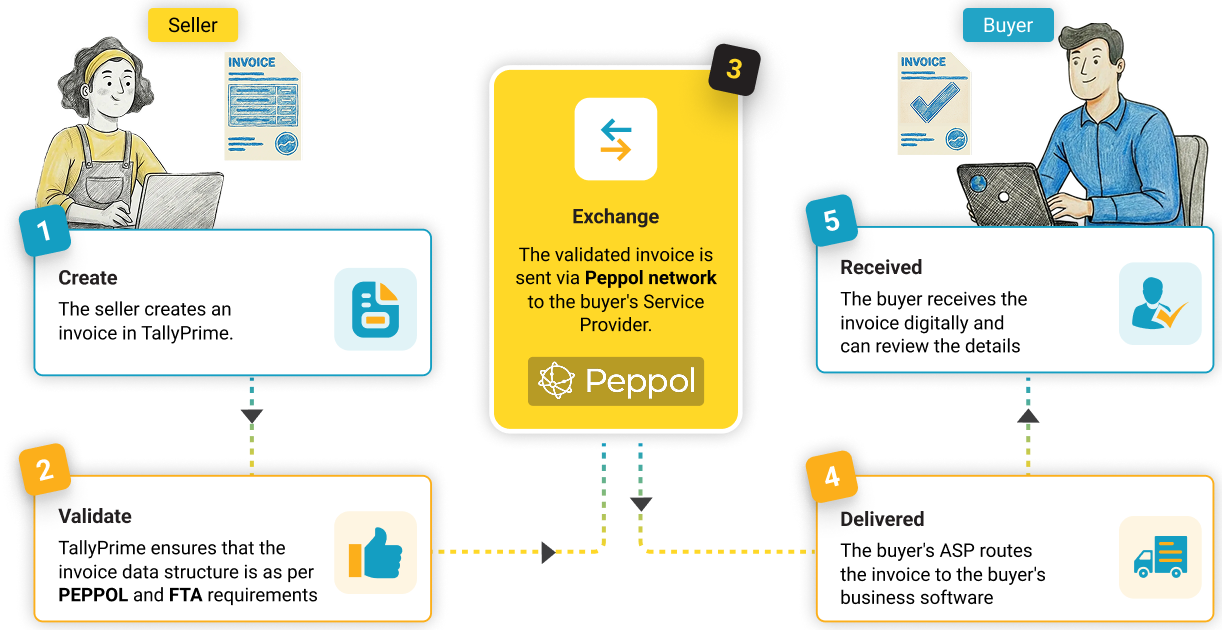

Smooth exchange of e-invoices

Exchange e-Invoices between buyers, sellers and the FTA securely using the Peppol network directly from TallyPrime.

Real-time FTA Reporting

Instant transmission of e-Invoicing data to the FTA, ensuring full legal compliance.

Ready for PINT AE

Automatic conversion of your invoices into the mandatory UAE-specific XML format.

Validation and reduced errors

Built-in checks help minimise errors, rejections, and rework.

Audit-Ready Archiving

Automated digital storage that meets the UAE's strict 5-year data retention laws.

Stay prepared for e-Invoicing with TallyPrime

Be the first to know when UAE e-Invoicing launches in TallyPrime

Get notified

Fill in your details and we'll keep you updated

How will UAE e-Invoicing work?

A secure e-Invoicing process powered by Peppol

Popular articles

Explore blogs to learn more about e-invoicing

FAQs

e-Invoicing will apply to businesses operating in the UAE that fall within the scope notified by the Federal Tax Authority (FTA) under the UAE e-Invoicing mandate. The rollout is expected to be phased, with different categories of businesses brought into scope over time.

Once notified, businesses will be required to issue and exchange invoices electronically in accordance with the UAE e-Invoicing framework.

e-Invoicing is being introduced to:

- Improve tax transparency and accuracy

- Enable real-time or near-real-time data exchange

- Reduce manual errors and invoice fraud

- Create a standardised, digital invoicing ecosystem

For UAE businesses, mandatory e-Invoicing ensures compliance with evolving tax regulations while supporting faster, more efficient invoicing processes.

To comply with UAE e-Invoicing requirements, businesses will need to:

- Use accounting or invoicing software that supports the UAE e-Invoicing framework

- Generate invoices in the prescribed structured format

- Exchange invoices through accredited Service Providers (ASPs) under the Peppol-based model

- Ensure invoice data can be shared with the FTA as required

The transition will typically be guided by official notifications from the FTA, along with timelines and technical requirements.

As of now, the UAE has not formally announced a final turnover threshold for mandatory e-Invoicing. The mandate is expected to be implemented in phases, and specific thresholds, business categories, and timelines will be notified by the FTA in due course.

Businesses are advised to start preparing early, even before thresholds are announced, to ensure a smooth transition when they fall within scope.

Once e-Invoicing becomes mandatory for a notified category of businesses, non-compliance may result in regulatory consequences, which could include:

- Invoices being treated as non-compliant

- Potential penalties as prescribed by the FTA

- Increased scrutiny during audits or assessments

Adopting e-Invoicing on time helps businesses avoid disruption, penalties, and last-minute operational challenges.

TallyPrime is in the process of aligning with the UAE e-Invoicing framework. Tally has achieved Full Member status of OpenPeppOL and is a certified Peppol Service Provider. As the next step, TallyPrime is undergoing the process to obtain accreditation from the UAE Ministry of Finance (MoF) as an Accredited Service Provider (ASP).

Once the accreditation process is completed, TallyPrime will support UAE e-Invoicing requirements in line with the Federal Tax Authority (FTA) framework.

Yes. Once the TallyPrime e-Invoicing solution is launched you can seamlessly exchange invoice data with buyers, sellers and FTA.

Yes. From creating invoices to validating them against UAE requirements and securely exchanging them through the Peppol network, TallyPrime exchanges e-Invoice data with the recipients seamlessly in the background, so you don’t need to leave the TallyPrime interface or rely on multiple tools.

The e-Invoicing solution will be available for UAE customers after the launch. If you are a new customer, buy TallyPrime to use e-Invoicing. If you are an existing customer, contact your partner to enable e-Invoicing after the launch.

TallyPrime offers a host of business management features for businesses including:

- Integrated accounting and inventory

- VAT filing

- Business reports

- Smart banking with integrated payments and accounting

- Payroll management

- Auto backup