Tally Solutions |Updated on: February 14, 2023

- What is GST Reverse Charge Mechanism?

- When is Reverse Charge Applicable?

- GST Reverse Charge Mechanism Scenarios on Service/Goods

- GST Reserve Charge Mechanism with Examples

- Who should pay GST under the RCM?

- What is Self-Invoicing?

- FAQs on GST Reverse Charge Mechanism

What is GST Reverse Charge Mechanism?

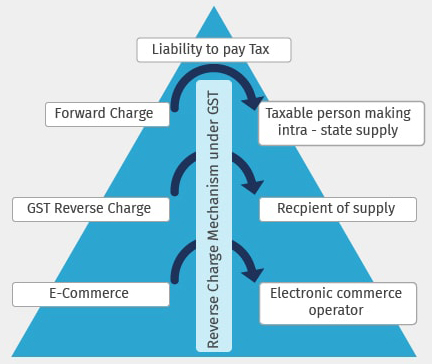

The reverse charge mechanism under GST means that the liability to pay by the recipient of supply of goods or services or both instead of supplier of such goods or services or both.

When is Reverse Charge Applicable?

GST on reverse charge is levied if there is Intra State supply of goods or services or both by an unregistered supplier to a registered person and the value exceeds Rs 5000 in a day.

A Diagrammatic View on Reverse Charge Mechanism under GST

GST Reverse Charge Mechanism Scenarios on Service/Goods

|

GST Reverse Charge Scenario No. 1 |

Services : · Nature of supply and/or nature of the supplier · this section is applicable whether the dealer is a registered dealer under GST or not · Under this scenario notified supply of goods and services are covered in which specified recipient is liable to pay tax under the reverse charge mechanism. · The Illustrative GST Reverse charge list here includes : · GTA Services; · Legal services by an advocate; · any service supplied by any person who is located in non-taxable territory to any person other than the nontaxable online recipient, · Services supplied by an arbitral tribunal to a business entity · Services provided by way of sponsorship to any corporate or partnership firm · Services supplied by the Central Government, State Government, Union territory or local authority to a business entity · Services supplied by the Central Government, State Government, Union territory or a local authority by way of renting of immovable property to a person registered under the CGST Act · Services supplied by a director of a company or a body corporate to the said company or the body corporate · Services supplied by an insurance agent to any person carrying on insurance business · Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company · Services supplied by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India · Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright · Supply of services by the members of Overseeing Committee to Reserve Bank of India Goods: The Illustrative GST Reverse charge list here includes : · Cashew nuts, not shelled or peeled · Bidi wrapper leaves (tendu) · Tobacco leaves · Silk yarn · Raw cotton · Supply of lottery · Used vehicles, seized and confiscated goods, old and used goods, waste and scrap |

|

GST Reverse Charge Scenario No. 2 |

Goods/Services · It covers the taxable supplies made by any unregistered person to a registered person · This scenario covers only those supplies where the aggregate value of such supplies of goods or service or both received by a registered person from any or all the suppliers, who are not registered, exceeds five thousand rupees in a day · The provisions of reverse charge under this scenario applies only for supplies made within the state Recent Amendments: This section of Reverse charge supply has been put on hold by the council ever since after September and it is now proposed to cancel this section of the Reverse charge mechanism under GST in the recently concluded GST Council meeting. |

GST Reserve Charge Mechanism with Examples

Example No.1: Mr. X, a registered supplier, engaged in the profession of Advocacy, buys stationary worth Rs. 200/- for his office from ABC Stationery, which is not registered under GST.

|

Analysis : · This is the case falling under Scenario 2 discussed above · Services by an unregistered person (ABC Stationary) to a Registered person (Advocate Mr. X) · But the aggregate value on a given day (Rs.200/- not exceeding Rs. 5,000/- limit in a day) |

|

Reasoning: Whether Mr. X or XYZ Stationery is liable to Reverse the charge under GST? · Reverse charge mechanism under GST says the recipient of supply should pay tax, in the given case Mr. X should pay GST Reverse charge but · Mr. X is not required to pay GST Reverse charge in the given case as the aggregate value of supplies on a given day has not exceeded Rs. 5,000/- |

Example No. 2: XYZ Transport services, Tamil Nadu provides Goods Transport Agency services to Mr. X (an unregistered dealer of Calcutta. The value of service provided by XYZ Transport company is Rs. 1000/-. Whether MR. X or the transport company is liable to pay tax under the reverse charge mechanism in GST?

|

Analysis : · This is the case falling under Scenario 1 discussed above · XYZ Transport company providing notified services from the GST Reverse charge list (GTA Services in the given case) · The scenario says that whether the person providing service or the person receiving service is registered or not (in the given case it doesn’t matter whether XYZ or Mr. X is a registered person · The part of scenario further says that the specified person has to pay tax on all such notified supplies (meaning if the person receiving the supply is an unregistered person then the law says that he must get registered and pay tax under reverse charge in GST |

|

Reasoning: Whether Mr. X or XYZ Transport Services is liable to Reverse the charge under GST? · The specified recipient to pay tax (Mr. X in the given case) · But Mr. X Since is an unregistered person has to first get registered under GST by obtaining GSTIN and pay tax on reverse charge under GST for supplies received from XYZ Transport Services |

Who should pay GST under the RCM?

The person who receives the goods and services is the one who must pay GST under the RCM. But it is vital that the supplier of the goods and services mentions that the tax is payable under RCM. The recipient of the goods and services can claim ITC only if they are used for business purposes. In certain cases, the GST compensation cess is available under the RCM. Composition dealers cannot claim ITC and they are required to pay normal tax rates under RCM.

What is Self Invoicing?

Self invoices are usually raised when a customer prepares the supplier's invoices and sends them for payment to respective parties. One of the biggest advantages of self invoicing is that the customer need not wait to receive an invoice from the supplier and reconcile it with the timesheet before payment.

FAQs

What happens if the receiver of goods and/or services is required to pay tax under Reverse Charge but is not a registered dealer?

In such scenarios, all the taxpayers who are required to pay tax under reverse charge must register for GST and the threshold of Rs 20 Lakhs is not applicable to them.

Is Input Tax Credit allowed under Reverse Charge?

Any amount payable under reverse charge shall be paid by debiting the electronic cash ledger. In other words, reverse charge liability cannot be discharged by using input tax credit. However, after discharging reverse charge liability, credit of the same can be taken by the recipient, if he is otherwise eligible.

What if an Input Service Distributor receives supplies liable to Reverse Charge?

If the distributor wants to take reverse charge supplies, they should ensure to get registered as a normal taxpayer but will not be able to distribute the tax credit available thereof.

Latest Blogs

Empowering MSMEs Through AI

Docker Quick Start Guide

How to Manage the Online Reputation of a Service Business

Inventory Forecasting for Small Businesses

Navigating Supply Chain Disruptions: Strategies for Resilience in Uncertain Times

5 Must Have Insights in Your Dashboard